Investment giant BlackRock has agreed to buy Global Infrastructure Partners (GIP), the world’s largest independent infrastructure manager for $12.5 billion in cash and stock.

New York-based GIP owns major stakes in CyrusOne and Vantage Towers, in addition to energy, transportation, and water and waste companies, including a stake in London’s Gatwick Airport.

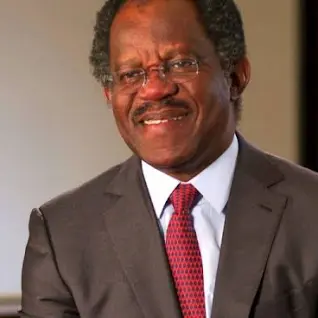

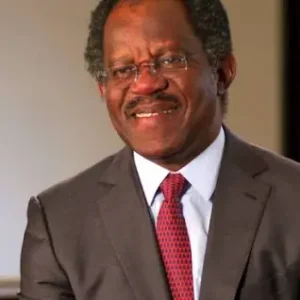

The deal, expected to close in Q3 2024, will see Bayo Ogunlesi join BlackRock’s board post-closing. The GIP management team, led by Ogunlesi and four of its founding partners, will lead the combined infrastructure platform.

The proposed acquisition comes against the backdrop of the increasing importance of infrastructure investments as governments worldwide prioritize self-sufficiency, security, and the reshaping of domestic industrial capacity. The economic significance of subsea cables, which improve international connectivity, is underscored by their role in driving GDP growth and job creation.

“Infrastructure is one of the most exciting long-term investment opportunities, as a number of structural shifts re-shape the global economy. We believe the expansion of both physical and digital infrastructure will continue to accelerate, as governments prioritize self-sufficiency and security through increased domestic industrial capacity, energy independence, and onshoring or near-shoring of critical sectors,” said Laurence D. Fink, BlackRock chairman and CEO.

“I’m delighted for the opportunity to welcome Bayo and the GIP team to BlackRock, and happy to announce our plans to have Bayo join our board of directors post-closing. We founded BlackRock 35 years ago based on a unique understanding of investment risk and the factors and forces driving investment returns. GIP’s deep understanding of the factors and forces driving operational efficiency for long-term value creation have made them a global leader in infrastructure investing. Bringing these two firms together will create the infrastructure platform to deliver best-in-class investment opportunities for clients globally, and we couldn’t be more excited about the opportunities ahead of us” Fink continued.

Founded in 2006, GIP manages over $100 billion in client assets, concentrating on infrastructure equity and debt. Their portfolio includes investments in energy, transport, water and waste, and digital sectors. Ogunlesi, the CEO of GIP, expressed enthusiasm about the collaboration, highlighting a shared culture of collaboration, client focus, and commitment to excellence between BlackRock and GIP.

“I’m excited about the power of this combination and the prospect of working with Larry and his talented team. We share with BlackRock a culture of collaboration, client focus, investment partnership, and commitment to excellence,” said Ogunlesi. “This platform is set to be the preeminent, one-stop infrastructure solutions provider for global corporates and the public sector, mobilizing long-term private capital through long-standing firm relationships. We are convinced that together we can create the world’s premier infrastructure investment firm.”

GIP’s diverse portfolio encompasses notable investments such as Gatwick, Edinburgh, and Sydney Airports, Suez (focused on water and waste management), Pacific National and Italo (in the rail sector), Peel Ports and Port of Melbourne. Additionally, GIP has a strategic presence in several renewables platforms, including Clearway, Vena, Atlas, and Eolian.