The rising cost of doing business in Ghana has emerged as a pressing concern, particularly for companies that rely heavily on stable electricity and fuel. Data centers and digital infrastructure providers are especially feeling the pinch from recent increases in utility tariffs and fuel prices. If these challenges are not effectively managed, they could have far-reaching repercussions for the sector and the broader economy.

Rising production costs

In the third quarter of 2024, Ghana witnessed increases in electricity and water tariffs, rising by 3.02% and 1.86%, respectively. Concurrently, fuel prices have been on the upswing, with Shell recently raising the price of petrol from GHS 13.49 to GHS 13.79 per liter and diesel from GHS 13.99 to GHS 14.35. These price hikes are driven by a combination of global and domestic factors, including geopolitical tensions in the Middle East, supply chain disruptions, and the depreciation of the Ghanaian Cedi against major currencies, which raises the costs of importing fuel essential for various industries.

Inflation has surged, with annual consumer inflation reaching 21.5% in September 2024, up from a near two-and-a-half-year low of 20.4%. This escalating inflation affects everything from operational costs to purchasing power, further complicating the business landscape for local companies.

The power challenge

Power is a critical element for the effective operation of data centers, ensuring that IT infrastructure runs smoothly even during disturbances. While Ghana is known for its relatively stable power supply, its capacity is limited, with a total installed power capacity of 5,134 MW and a dependable capacity of 4,710 MW. Data centers primarily rely on the national grid, and while backup generators are in place, they are not always sufficient to mitigate the risks associated with unexpected power outages.

High costs related to downtime present a significant risk for data centers. A study of 67 data centers found that the average cost of downtime can exceed $7,500 per minute. In an increasingly interconnected world, reliable power becomes essential for data centers to meet rising demands and avoid catastrophic operational failures.

Data center landscape in Ghana

Currently, Ghana has seven data centers, four of which are carrier-neutral: MDXI (Equinix), Onix, PAIX, and the National Information Technology Agency (NITA). Only four of these facilities are certified by the Uptime Institute: Onix Data Centres (Tier IV), MainOne’s MDXI (Tier III), and NITA’s facilities in Kumasi and Accra (Tier II and III). Africa Data Centres and Digital Realty are incoming operators that expect to take a stake in the country’s digital infrastructure ecosystem.

However, while a 99% uptime might seem acceptable, it translates to about 3.65 days of downtime annually, which is a modest 5,256 minutes and $39.4m downtime cost per year. Achieving a more robust uptime standard of five-nines (99.999%), as guaranteed by Tier V is crucial for data centers aiming to provide uninterrupted services. This standard allows for only 5.25 minutes of downtime per year, significantly enhancing reliability and trust among clients. Without consistent 24/7 power supply, it is impossible for data centers to mitigate downtimes.

Impact on data centers

For data centers, a steady and affordable electricity supply is indispensable. The recent tariff hikes, although seemingly modest, can have substantial cumulative effects on companies with high energy consumption. This scenario could lead to price adjustments that ultimately trickle down to small and medium-sized businesses (SMBs) that depend on local cloud services, web hosting, and data storage. As utility costs rise, these SMBs may find it increasingly difficult to compete in the digital economy.

A data center operator who pleaded anonymity said, “With rising utility costs, we face tough decisions about how to maintain our services without compromising quality. Everyone is optimizing operations and cutting costs. If these increases continue, we risk stunting the growth of local businesses that rely on our infrastructure to thrive. Customers may begin to scale down services or expansions and this will significantly impact digital inclusion im Ghana.”

In addition to electricity costs, rising fuel prices are another pressing concern for data centers. Many facilities rely on backup generators to maintain operations during power outages—something that occurs frequently in Ghana. However, as fuel costs increase, the financial burden of maintaining these generators also rises. This reality leaves companies with challenging choices: absorb the higher costs and risk shrinking margins or pass them onto customers and potentially jeopardize their competitive edge.

Slowed digital growth

Ghana’s digital infrastructure has been on a growth trajectory, buoyed by increasing demand for cloud computing, web hosting, and various digital services. Nevertheless, the escalating costs of power and fuel could slow this growth. Rising operational costs will likely be passed on to consumers, which may erode the digital access gains achieved over recent years. Furthermore, potential new investments in infrastructure may be delayed, and some companies could even consider relocating to neighboring countries with more stable and affordable utility costs.

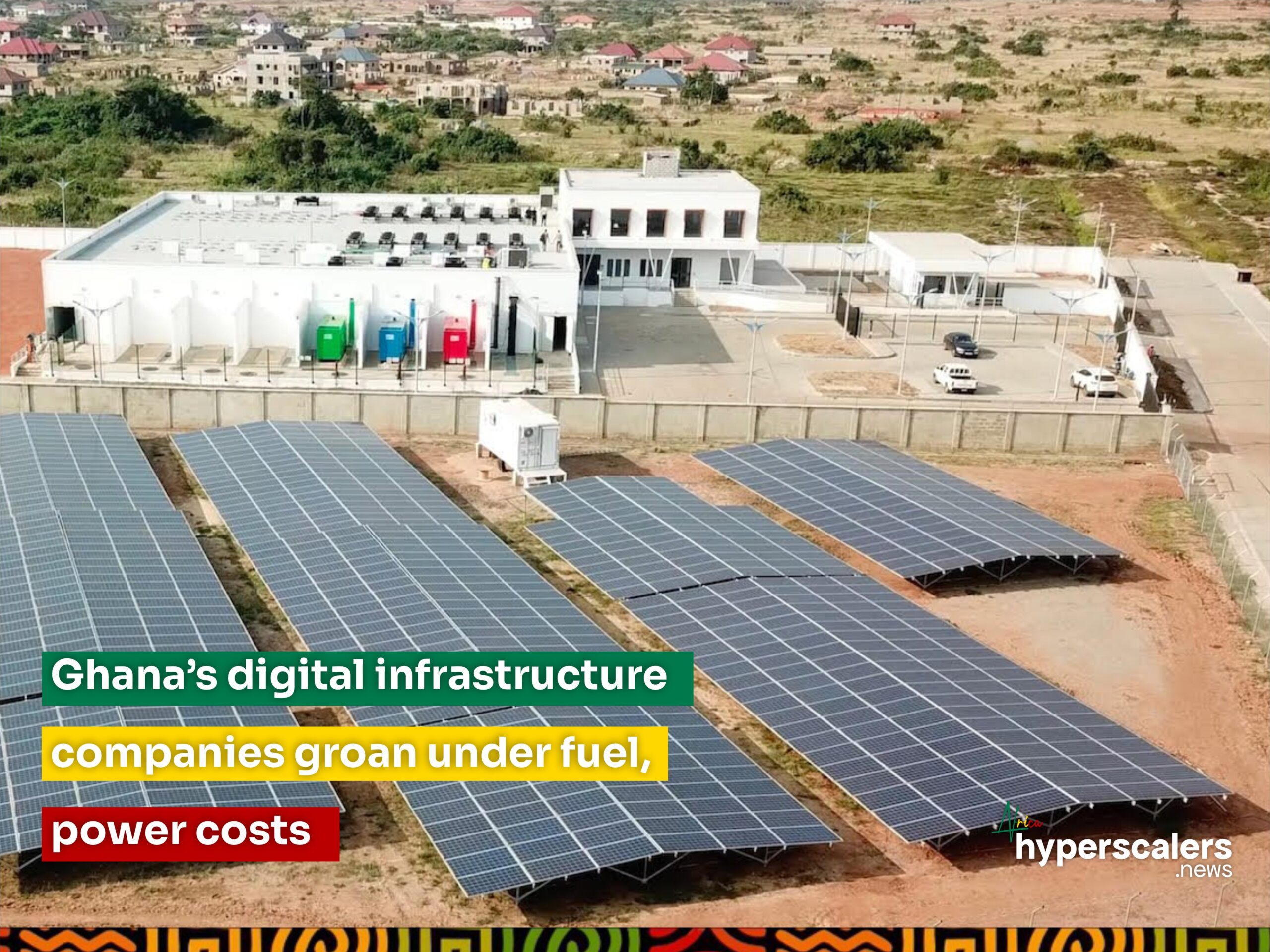

As companies seek long-term solutions, there is growing interest in transitioning to greener energy options, such as solar or wind power. While these alternatives could yield cost savings in the long run, they require significant upfront investments. In the meantime, businesses must navigate the immediate challenges posed by higher operating expenses.

What needs to change

There is mounting pressure on the government to reassess the method of adjusting utility tariffs. The Association of Ghana Industries (AGI) has called for annual rather than quarterly reviews of electricity and water prices. This approach would provide businesses with more predictability, allowing for better financial planning and the ability to absorb cost increases more efficiently.

Additionally, there is an urgent need for enhanced collaboration between the private sector and the government to improve the country’s energy infrastructure. By stabilizing the power supply and lowering costs, Ghana could create a more favorable environment for data centers and other digital infrastructure companies to thrive. Operators like Onix are advocating for a shift toward solar energy, but the current capacity for such solutions remains limited.

A more resilient digital Ghana

For data centers and digital infrastructure companies in Ghana, the rising costs of fuel and electricity represent more than a minor inconvenience—they pose a significant threat to profitability and the ability to provide consistent, reliable services. If these costs continue to rise unchecked, they could hinder the growth of Ghana’s digital economy, impacting everything from local startups to large multinational firms operating in the region.

Stabilizing the cost of doing business is crucial for maintaining the momentum of Ghana’s digital transformation. By ensuring that data centers and digital infrastructure companies can continue to support the country’s economic growth, Ghana can secure its position in an increasingly digital world. Addressing these challenges will require concerted efforts from both the government and the private sector to foster a more resilient and competitive environment for all stakeholders involved.