…Legend Internet becomes first ISP to list on local exchange, signaling new era for African infrastructure operators

Last week, Northern Nigeria’s Legend Internet Plc made history by becoming the first indigenous Internet Service Provider (ISP) to list on the Nigerian Exchange Limited (NGX), marking a major milestone for the country’s digital infrastructure sector.

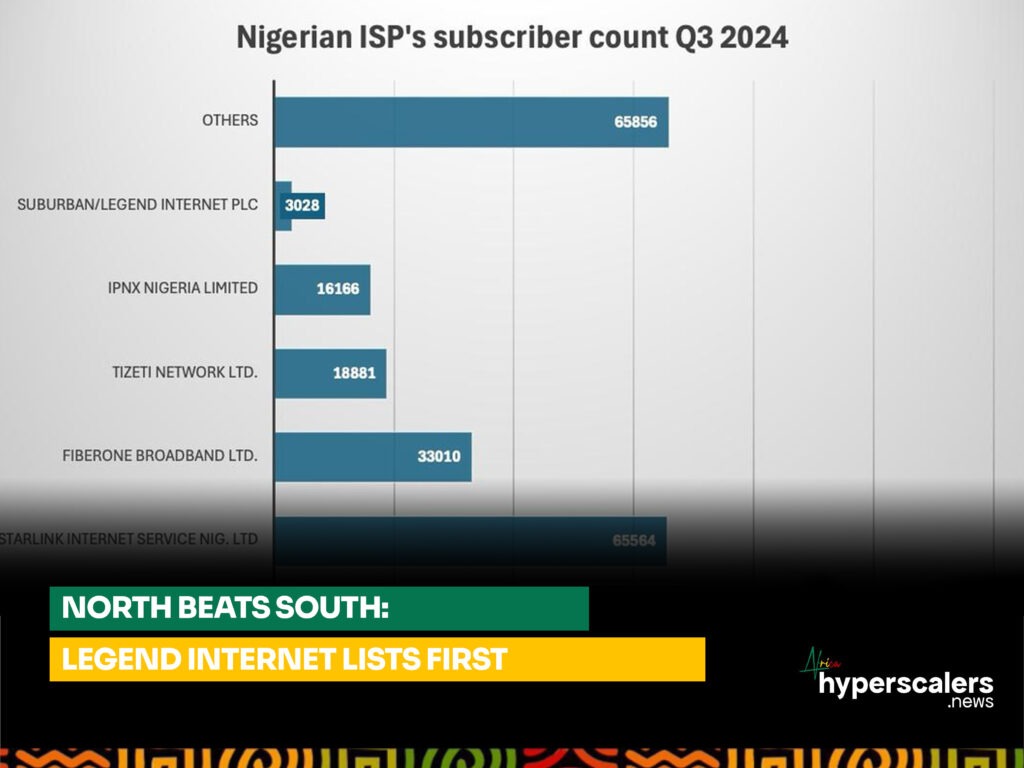

The company introduced 2 billion ordinary shares at ₦5.64 per share, adding ₦11.28 billion ($7 million) to the exchange’s market capitalization. Despite having just a fraction of the subscriber base of larger competitors such as FiberOne, Legend beat the odds to reach the public markets first – a move seen as both symbolic and catalytic for the industry.

The listing challenges long-held assumptions about Northern Nigeria’s commercial viability in the technology space. Historically viewed as a less dynamic market compared to the South, the North now finds in Legend a case study for homegrown digital innovation capable of attracting institutional investor attention.

The stock gained nearly 10 percent on its first day of trading, closing at ₦6.20, reflecting strong investor appetite for digital economy plays. Legend pursued a “Listing by Introduction,” raising no new capital but fully meeting regulatory requirements for public trading.

Financials released at the NGX’s “Facts Behind the Listing” event showed a company managing significant macroeconomic headwinds while maintaining profitability. Legend reported ₦1.14 billion in 2024 revenue, a slight dip from ₦1.21 billion the previous year, as foreign exchange constraints and softer household demand weighed on performance.

Even so, cost controls were effective. Cost of sales fell 21 percent to ₦461 million, while total assets grew 4.4 percent to ₦3.03 billion. Retained earnings improved 27 percent, positioning Legend for sustainable growth. Although earnings after tax fell by more than half to ₦119 million, the company’s resilience stands out in a challenging operating environment for broadband providers.

Fiber services accounted for 97 percent of revenue, highlighting Legend’s focus on delivering high-reliability, last-mile broadband services rather than relying on consumer offerings.

Yet Legend is aiming to be more than just an internet company. Through products like LegendMail, an email service with built-in payments, and LegendPay, a digital wallet, the company is positioning itself to offer a full digital lifestyle rather than just broadband connectivity. The ambition is to integrate communication, payments, and financial services into one seamless platform for Nigerian users.

“We are building Africa’s most customer-focused internet company, powered by world-class infrastructure and made-in-Nigeria innovation. Going public enables more Nigerians to be part of our journey and share in the value we are creating,” said Aisha Abdulaziz, Chief Executive Officer of Legend Internet.

“Technology is the fastest-growing sector, and broadband sits at the core of digital transformation,” said Ladi Bada, Chairman of Legend Internet Plc. “Our decision to list is anchored in our belief that the capital market is a catalyst for growth, innovation, and national economic transformation.”

Temi Popoola, Group Managing Director and CEO of NGX Group, emphasized the broader market significance. “Broadband is investment-heavy and capital-intensive. Legend’s entry into the market is not only timely; it’s visionary,” he said.

Legend’s listing comes at a pivotal time. Other ISPs, such as Tizeti, have also expressed plans to list. Legend’s achievement highlights the structural challenges ISPs have to overcome when raising domestic equity capital, from regulatory complexity to shallow market liquidity and a need for stronger investor education around infrastructure business models.

Historically, African tech and digital infrastructure firms have leaned heavily on private equity, venture capital, and development finance institutions. Public listings have been rare, particularly for operators like Legend, whose models demand sustained capital investment and long-term investor patience.

Analysts say the listing could open doors for more indigenous infrastructure players. “Legend’s success shows that Nigeria’s capital markets can support infrastructure-heavy, growth-stage companies if governance, transparency, and strategy are aligned,” said a Lagos-based investment banker familiar with the deal.

Despite its achievements, Legend’s story becomes even more striking when set against industry benchmarks. The parent company, Suburban, reports just over 3,000 active subscribers, compared to FiberOne’s 33,000, ipNX’s 16,000, and Tizeti’s 19,000, according to regulatory filings from the Nigerian Communications Commission. That makes Legend way smaller than its peers – yet it crossed the public listing finish line first.

Why haven’t larger operators explored Nigeria’s stock markets yet? The answer may lie in deeper structural realities within Nigeria’s investment landscape.

By contrast, Kenya’s ISP sector appears far more capital-friendly. Together, the country’s top four ISPs control about 90 percent of active subscribers, yet only Safaricom Plc, with a 36.6 percent market share, is listed on the Nairobi Securities Exchange. The others – Jamii Telecommunications (24.4 percent), Wananchi Group (16.8 percent), and Poa Internet (12.6 percent) – remain privately held.

Poa alone has raised around $36 million in private funding, serving over 22,000 homes and tens of thousands more through public Wi-Fi hotspots across Nairobi.

In Nigeria, there is far less visibility into the capital-raising activities of pure-play ISPs like ipNX and FiberOne. According to TechCabal, Tizeti has raised $7.4m. Compared to Poa’s $36 million war chest, Tizeti appears to have expanded its footprint with leaner resources. This suggests that while Nigerian ISPs have struggled to attract the same scale of private investment as their East African counterparts, they have delivered more with less.

However, where the rubber truly hits the road in Nigeria is in its declining foreign exchange (FX) environment. Limited access to stable FX has placed significant pressure on ISP operations, from the cost of importing critical network equipment to servicing dollar-denominated obligations. As the naira continues to weaken, operators face rising input costs and shrinking margins, making it harder to scale or reinvest without turning to expensive local borrowing or raising prices for already stretched consumers.

Without macroeconomic reforms or fresh capital solutions, even the most disciplined operators could find their growth ambitions derailed.

Legend’s listing, therefore, is significant not only for its first-mover optics but for what it signals about the shifting ambition – and enduring challenges – facing Nigeria’s digital infrastructure sector. Whether others will follow will depend largely on whether Legend can now turn its early listing into real, scalable growth.

Incorporated in August 2021, Legend has rapidly built a dominant position in Abuja’s fiber-to-the-home market. Its accounts were audited by Lagos-based Poju Professional Services, a choice that highlights the potential for indigenous professional services firms to gain more prominence as local tech and infrastructure companies pursue public listings.

As AI, cloud computing, and remote work drive surging broadband demand, Legend’s public debut signals a broader shift: infrastructure players can increasingly scale with domestic capital, and ordinary Nigerians now have a chance to own a stake in the backbone of their digital economy.