Nigeria aims to become a global leader in Artificial Intelligence (AI), but this ambition hinges on building a robust digital infrastructure. Essential elements of this infrastructure include data storage, cloud computing, reliable communication networks, and secure power connections—all crucial for unlocking AI’s full potential.

The International Monetary Fund (IMF) has noted that the world is on the verge of a technological revolution that could boost productivity, global growth, and incomes. To capitalize on this, Nigeria convened 120 stakeholders in April 2024 to draft a National AI Strategy. However, the draft document reveals significant gaps, including unreliable internet connectivity, insufficient data centers, and limited access to cloud computing services.

Despite having nine submarine cables, Nigeria’s 90,000-kilometer fiber infrastructure gap results in slow and unreliable internet. Nigeria ranks 11th and 140th globally in mobile and fixed broadband, respectively. The Portulans Institute’s Network Readiness Index scores Nigeria at 35.73, ranking 106 out of 134 economies, while Oxford Insights’ AI Infrastructure Index gives it a score of just 42.67.

“Nigeria aspires to be a global leader in AI, but achieving this vision requires foundational infrastructure for AI and other emerging technologies,” said the stakeholders. The draft strategy emphasizes the need for affordable, localized infrastructure and sufficient computing capacity to support a thriving AI ecosystem.

The draft also highlights the necessity of modern data centers, equipped with advanced computing resources and data stacks, which Nigeria currently lacks. With only about 12 data centers, including Rack Centre, Main One, Open Access Data Centres, and MTN, Nigeria faces a $600 million data center gap. “We do not have enough data centers. Xalam Analytics shows that Africa has only 1 percent of the global digital infrastructure,” said Ayotunde Coker, CEO of Open Access Data Centres (OADC).

Existing data centers must be upgraded to meet AI demands. Nigeria is only beginning to build its first hyper-scale data center through Airtel Africa. Hyperscale data centers, designed for large-scale IT infrastructure, number around 700 globally. South Africa built its first hyperscale data center about seven years ago.

Unreliable power supply also disrupts AI model training and deployment, affecting performance. Frequent power outages hinder research and development, slowing progress. By 2030, AI is expected to contribute $2.9 trillion to Africa’s GDP, with Nigeria’s AI market projected to reach $434.4 million by 2026. Bosun Tijani, Minister of Communications, Innovation, and Digital Economy, emphasized, “There will be a convergence of AI systems, so Nigeria should be part of that global superpower in the development and regulation of AI.”

To address these issues, the draft National AI Strategy recommends establishing national High-Performance Computing (HPC) centers, investing in AI-specific hardware and software, setting up clean energy AI clusters to reduce grid dependence, and offering tax breaks and incentives to encourage investment in critical AI infrastructure.

The strategy also underscores the need to build a vibrant ecosystem of partners, academia, and a skilled workforce to support Nigeria’s AI ambitions. Nigeria is already making strides to address these gaps. During the AI workshop that led to the AI strategy, Tijani announced several initiatives, including the relaunch of the National Centre for AI and Robotics (NCAIR) to promote research and development in emerging technologies.

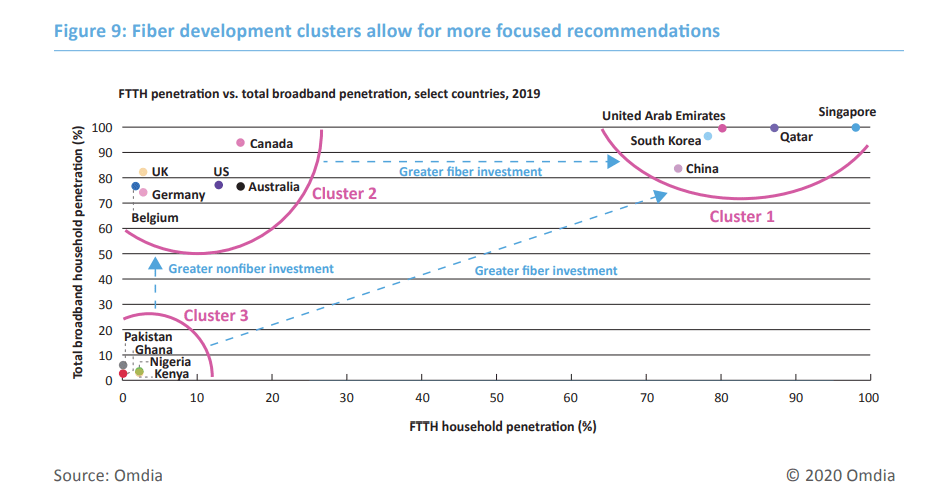

Additionally, the Ministry of Communications plans to deploy 90,000 kilometers of fiber nationwide over the next two to three years. This $2 billion project will be executed in collaboration with development finance institutions such as the World Bank and the African Development Bank (AfDB). While this expansion is a significant step forward, Nigeria’s broadband penetration remains very low, with fewer than 10% of people subscribing to fixed broadband services. This low penetration is due to insufficient backbone capacity, gaps in middle and last-mile connectivity, a lack of a sustainable broadband policy, and insufficient incentives for operators to invest in digital infrastructure. In its 2020 Global Fiber Development Index, Omdia Research ranked Nigeria as a Cluster 3 country, indicating emerging broadband infrastructure but low household broadband penetration and relatively low fiber-to-the-home (FTTH) adoption.

Investing in digital infrastructure today is essential not only for technological advancement but also for fostering innovation and socioeconomic development.