American semiconductor company and leading manufacturer of high-end graphics processing units (GPUs), Nvidia, has reported 256 percent increase in revenue, reaching $22.10 billion compared to the same quarter last year, and beating Wall Street’s earnings expectations. The standout performer in this growth trajectory was the data center-specific revenue, which skyrocketed by 409 percent to $18.4 billion, exceeding market expectations of $17.06 billion. Concurrently, the gaming sector also experienced a substantial uptick, climbing by 56 percent to $2.87 billion.

This robust earnings report from Nvidia serves as a barometer for the state of generative AI, drawing widespread anticipation. Nvidia’s shares have outperformed those of major tech giants like Alphabet and Amazon, as well as the entire Chinese stock market. The consistent growth in data center sales is a notable trend, with revenues witnessing a steady climb quarter after quarter. For instance, the previous quarter saw data center revenue hitting $14.51 billion, marking a 279 percent increase, while the preceding quarter recorded $10.32 billion, up by 171 percent. In Q1, it amounted to $4.28 billion, reflecting a notable 14 percent increase. It’s noteworthy that a significant portion of Nvidia’s data center sales stemmed from leading cloud providers.

Despite these encouraging results, Nvidia remains cautious about the persistent shortage of its latest high-end GPUs. Colette Kress, Nvidia’s CFO, highlighted that although the supply of Hopper architecture products is improving, robust demand continues to pose supply constraints.

“We are delighted that the supply of Hopper architecture products is improving”, said Kress. “Demand for Hopper remains very strong. We can expect our next generation products to be supply constrained as demand far exceeds supply” she noted.

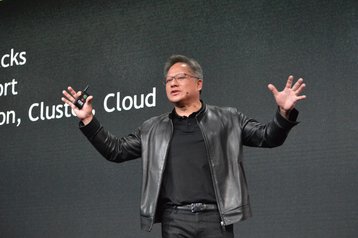

Nvidia’s forthcoming plans include the introduction of the B100 GPU later this year as a successor to the H100. Jensen Huang, Nvidia’s founder and CEO, emphasized the accelerating demand for accelerated computing and generative AI, characterizing it as reaching a tipping point.

Huang had earlier predicted a significant surge in data center infrastructure investment over the next four to five years, estimating a total value of around $2 trillion worldwide.