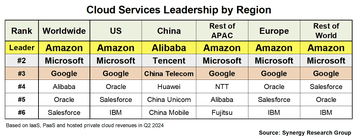

Synergy Research Group reveals that AWS, Microsoft, and Google continue to dominate the global public cloud market, with a combined market share far surpassing all other competitors except in China. According to the report, AWS holds 32% of the market, followed by Microsoft at 23% and Google at 12%. No other company managed to secure more than 4% of the market share.

Following these top three giants are Alibaba, Oracle, and Salesforce, which are battling for position in the global rankings. However, the situation in China is notably different, with local providers like Alibaba, Tencent, China Telecom, and Huawei leading the market. In fact, all of the top ten cloud providers in China are domestic firms, underscoring the dominance of local players in that region.

Geographically, the United States remains the largest cloud market, trailed by China, Japan, the UK, Germany, and India. The report highlights that the rankings of AWS, Microsoft, and Google remain consistent across all regions outside of China.

John Dinsdale, chief Analyst at Synergy Research Group, emphasized the sheer scale at which these companies operate. “This is quite simply a game of scale. Amazon, Microsoft, and Google now have a global network of over 560 operational hyperscale data centers. In Q2 alone, they invested over $48 billion in capex, most of which went towards building, equipping, and updating their data centers and associated networks,” Dinsdale said.

Despite the dominance of these global giants, Dinsdale noted that there are still opportunities for local companies to compete in their home markets. These companies can leverage specific services and demonstrate a competitive advantage relative to the industry leaders.

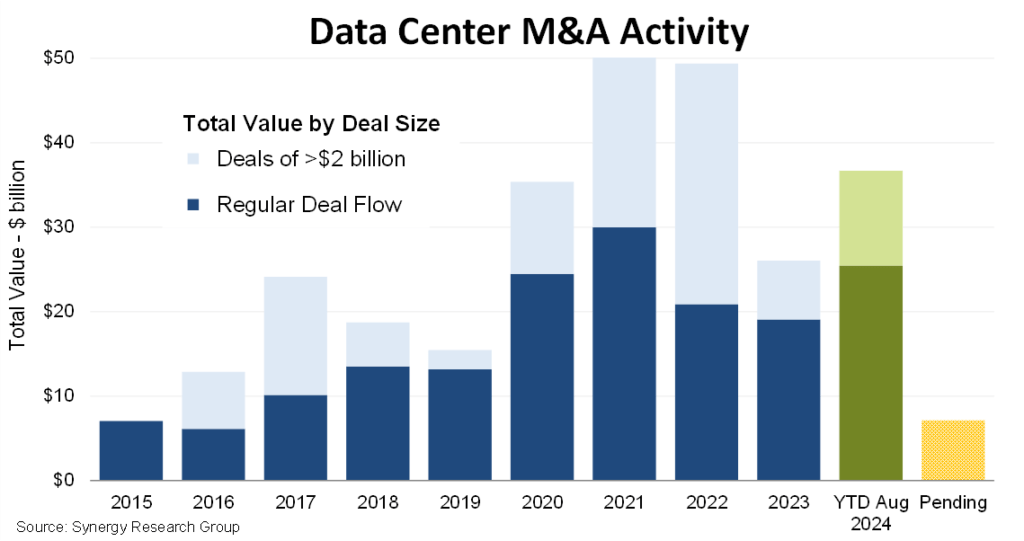

The report also touched on the growing trend of mergers and acquisitions (M&A) in the data center industry. Synergy Research Group forecasts that M&A deals are set to reach record levels in 2024, surpassing $40 billion. So far in 2024, closed deals have been valued at $36.7 billion, with an additional $7.1 billion agreed but not yet finalized.

The surge in M&A activity follows a relative lull in 2023, with the peak years being 2021 and 2022, during which the total value of closed deals reached approximately $50 billion. The report attributes this peak to four of the largest deals ever seen in the data center industry, each valued at $10 billion or more, including CyrusOne, Switch, CoreSite, and QTS acquisitions.

Dinsdale explained that the increasing demand for data center capacity, driven by cloud services, social networking, and a range of digital services, is fueling this trend. “There has been an inexorable rise in the demand for data center capacity, driven by cloud services, social networking, and a range of both consumer and enterprise digital services,” Dinsdale noted. “The rise of generative AI is adding a further boost to demand. Specialist data center operators have either not been able to fund those investments themselves, or they were not prepared to put their balance sheets at risk.”

He also pointed out that data centers have become a “long-term safe haven for investments,” leading to a massive influx of private equity. The report indicated that private equity has accounted for 85 to 90 percent of the value of closed deals since 2021.