Recent digital infrastructure gatherings across Africa have hammered home a recurring message: the continent’s digital future will not be built by subsea cables and cell towers alone. From Lagos to Nairobi, the conversations have revealed the same truth – investment is flowing, demand is rising, and infrastructure is expanding, but Africa risks repeating a familiar cycle: exporting raw potential while importing value at a premium.

Collaboration at scale is no longer optional. Without it, Africa will fall behind in the AI era. The question is what collaboration looks like across 54 countries and thousands of operators, regulators, financiers, and innovators.

Telcos at a Crossroads

Africa’s mobile operators – once celebrated for connecting the unconnected – now face a harsher reality: connectivity alone is not enough. Average revenue per user has fallen sharply, particularly in low-income markets where rollout costs outweigh returns. Taxes, vandalism, and regulatory headwinds eat into margins, while satellite players lure away customers with faster speeds and flexible options.

To stay relevant, operators must shift from localized fiber fiefdoms to true service platforms – offering enterprise cloud, fintech, cybersecurity, and AI-driven solutions. Without reinvention, they risk being commoditized in a digital economy where global players with deep pockets are already capturing the higher-value layers.

The $100 Billion Question

But reinvention requires capital, and lots of it. Africa faces a broadband financing gap of roughly $100 billion, with another $40 billion needed for data centers. The capital exists, but investors demand predictability, liquidity, and local participation. When major operators report nearly a thousand cases of infrastructure vandalism each month, appetite cools further. Without de-risked structures, secondary markets, and stable policy regimes, the long-term funding needed to scale will remain elusive.

PPPs: Promise and Pitfalls

With debt-to-GDP ratios topping 60% in many states, government balance sheets are too strained to carry this alone. That leaves public-private partnerships as Africa’s best bet to bridge the financing gap. But PPPs must be rooted in African realities. The winners will be lean, transparent projects tied to market needs such as last-mile broadband, resilient power, and regional data centers. Vanity projects and opaque procurement will only stall progress.

The Rise of Data Centers and Cloud

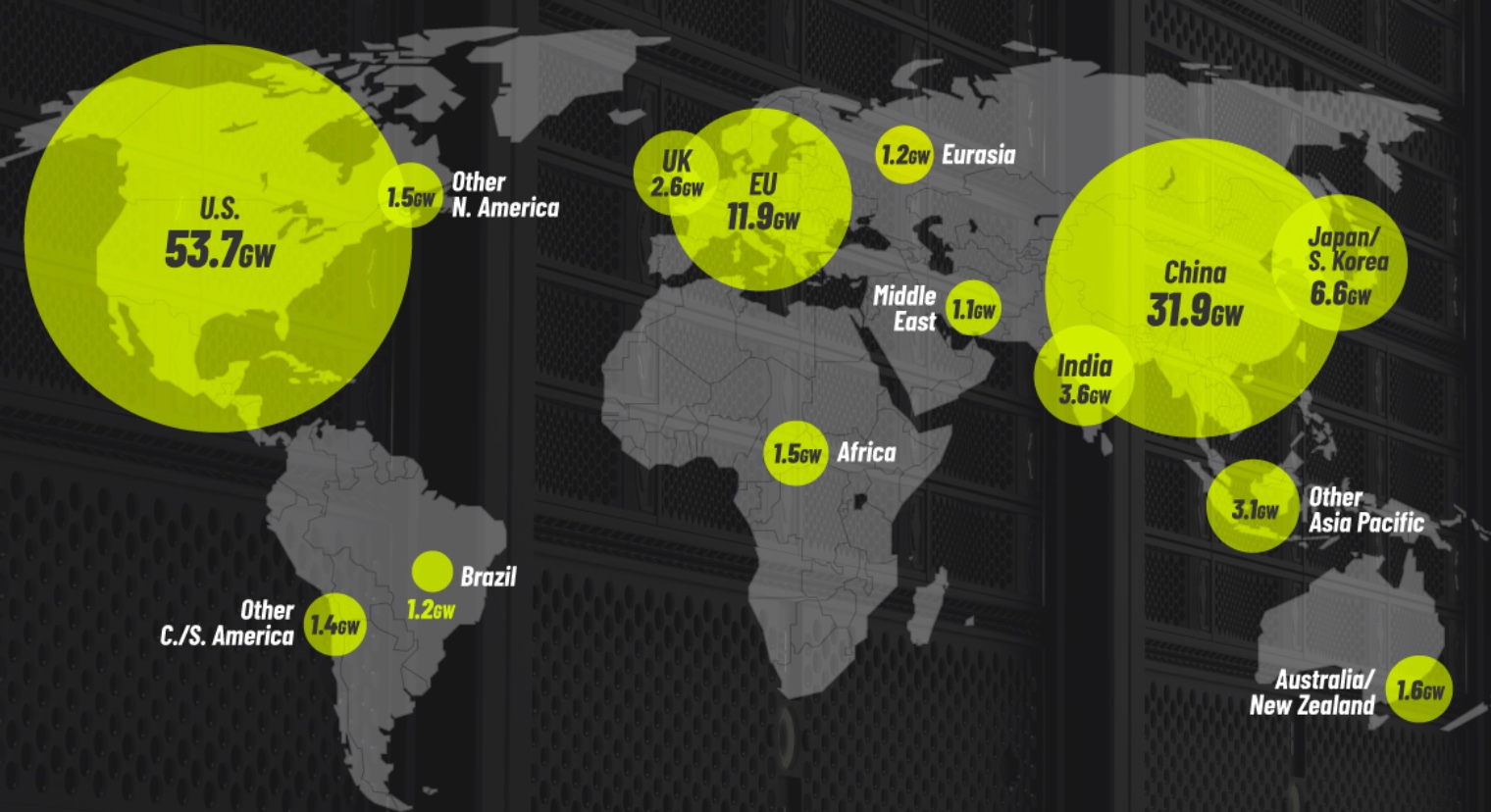

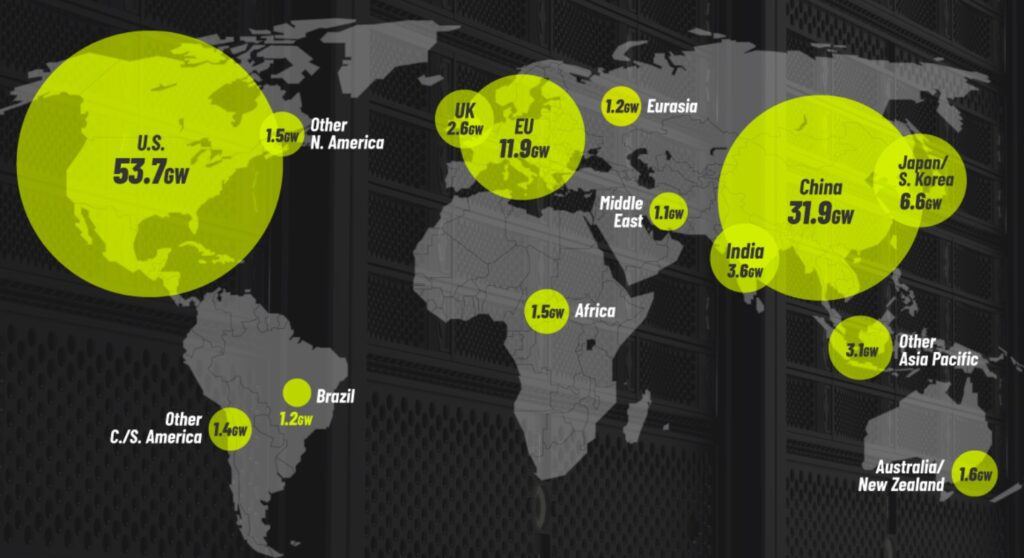

From Lagos and Nairobi to Johannesburg and Cairo, a new wave of data centers is coming online, serving enterprises, hyperscalers, and governments hungry for compliant, low-latency services. Yet Africa still accounts for less than 1% of global compute power, with most capacity clustered in just four markets. That concentration forces vast amounts of data offshore, inflating costs and latency. Unless more regional hubs and sovereign compute emerge, Africa risks remaining a passive consumer of global services rather than a producer of its own digital intelligence.

Sovereignty or Silos?

Data sovereignty is rising on every policy agenda, but most countries are drafting rules in isolation. The result is a patchwork that risks undermining integration. The alternative is harmonization: interoperable frameworks under the African Continental Free Trade Area and the Network of African Data Protection Authorities, coupled with sovereign compute, to give Africa real leverage in cloud and AI. Without scale and alignment, sovereignty will be sovereignty in name only.

Power: The Defining Constraint

No issue looms larger than energy. More than 600 million Africans still lack electricity, and per capita consumption in sub-Saharan Africa averages just 180 kWh – compared with 6,500 kWh in Europe and 13,000 kWh in the U.S.

Data centers are already straining the grid. A single 1 MW facility can consume as much energy as a small town. Enterprise-grade sites in Johannesburg, Kampala, and Lagos are being designed for 50–100 MW, while next-generation AI workloads require racks consuming over 100 kW each. Without robust power strategies, Africa’s digital ambitions will slam into a ceiling.

The path forward cannot be copy-pasted from Western models. Africa must lean on its strengths – abundant renewable resources, natural gas as a transitional fuel, and cross-border trade corridors. Power is no longer a utility in the background; it is the new competitive moat.

Cloud and Services Converge

Enterprises now demand turnkey ecosystems: connectivity, compute, compliance, and AI-readiness. The line between carrier, colocation provider, and cloud operator is fading fast. Across Africa, telcos, data center operators, and subsea consortia are repositioning as end-to-end platforms. Cloud adoption, once halting, is now growing in double digits. As local data centers expand beyond colocation into hybrid and multi-cloud, the race is on to build sovereign capacity that can host sensitive workloads and power the continent’s AI ambitions.

The Skills Deficit

Even the most ambitious infrastructure will fail without people to run it. Africa’s digital buildout is colliding with a shortage of engineers, cybersecurity experts, and architects. Hiring cycles drag, costs rise, and roles remain unfilled. Restrictive visa regimes compound the challenge: a Nigerian engineer cannot easily work in Kenya or Ghana. Extending AfCFTA to cover digital skills – through mutual recognition of certifications and streamlined hiring – could unlock a true pan-African workforce. Without it, infrastructure risks outpacing talent.

The Policy Puzzle

Billions have been invested in cables, towers, and data centers, but too often the sector remains siloed. Coherent policies that bind national strategies into regional frameworks are still rare. Without them, Africa risks squandering its greatest advantage: scale. With 1.4 billion people and a $3.4 trillion single market under AfCFTA, the opportunity is immense. But fragmented regulation will only perpetuate duplication, inefficiency, and lost competitiveness.

The Continental Consensus

Across these debates, the threads converge: telcos must reinvent themselves as platforms; capital must be unlocked through risk-sharing frameworks; sovereignty must scale to matter; power is the bottleneck, but efficiency is the moat; cloud and services are converging; collaboration, not silos, will define success.

The stakes are continental. Either Africa builds its own backbone for the digital economy, or it remains a consumer of intelligence generated elsewhere.

These questions will take center stage at Hyperscalers Convergence Africa 2025, on October 7 in Lagos. Panels will explore the journey to 2,500 MW of data center capacity, powering progress through sustainable energy, building digital arteries of connectivity, and unlocking patient capital. By confronting these challenges collectively, Africa can move from conversation to execution – and from potential to power.

Ready to dive deeper into the hyperscale revolution impacting Africa?

READ MORE HERE: www.africa.hyperscalers.news

Contact Us:

Email: projects@hyperscalers.news

Phone: +2348109003350

Follow us on Social Media: Instagram, Facebook, LinkedIn, x