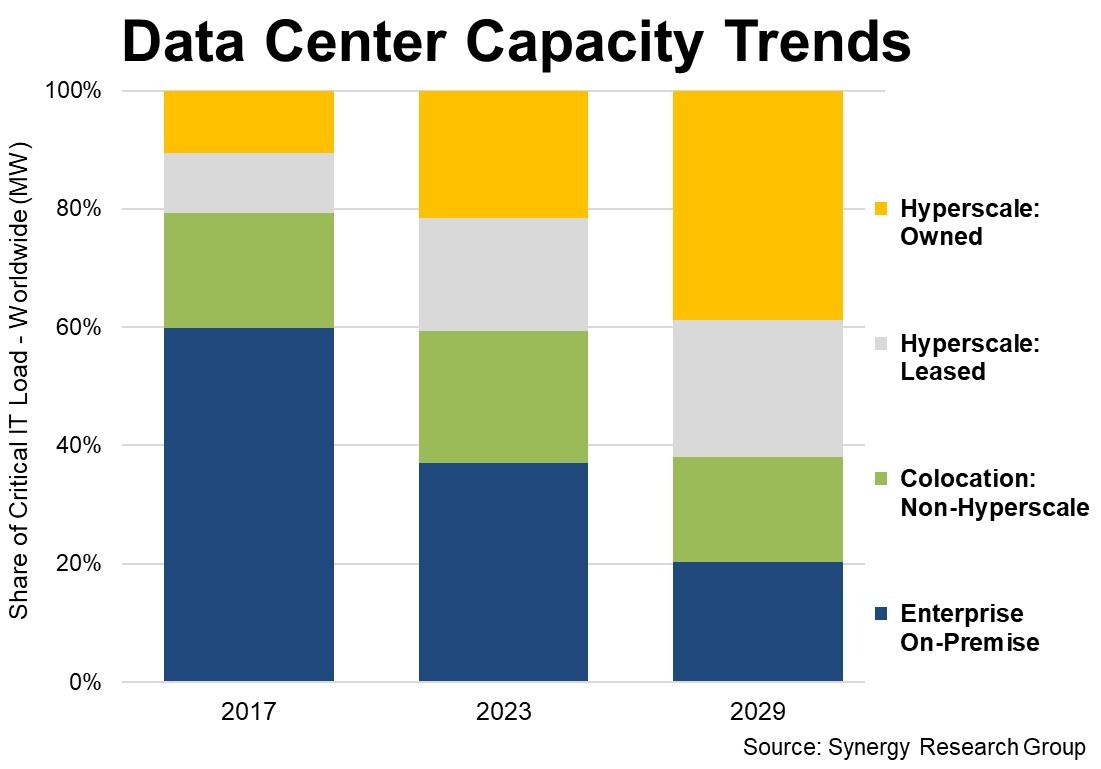

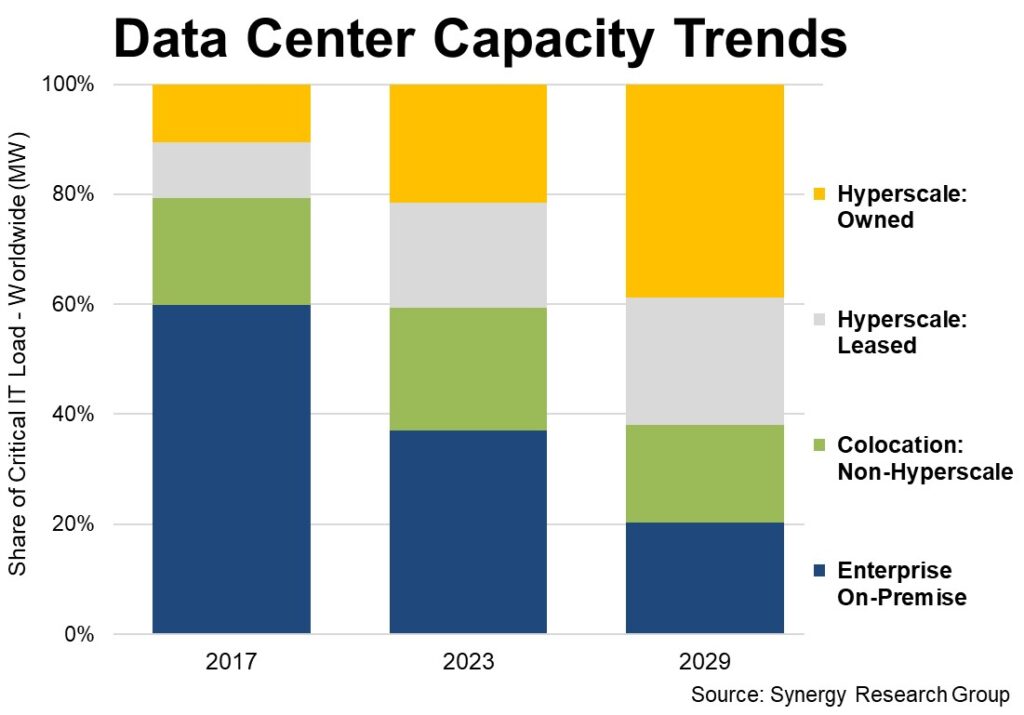

Hyperscalers now control 41 percent of global data center capacity, according to a Synergy Research report. This marks a significant growth from just six years ago when on-premise data centers dominated with a substantial 60 percent share of capacity.

Currently, non-hyperscaler colocation facilities account for an additional 22 percent of capacity, while on-premise data centers make up the remaining 37 percent. Looking ahead, Synergy forecasts that hyperscalers will expand their share to more than 60 percent by 2029, with on-premise data centers falling to just 20 percent.

Data center capacity is expected to grow substantially, with hyperscale capacity predicted to triple over the next six years. Although colocation capacity will also rise, its percentage share is anticipated to gradually decline, while on-premise capacity is expected to stabilize.

John Dinsdale, Chief Analyst at Synergy Research Group, notes that data center capacity varies significantly by region. “Hyperscale-owned data center capacity is much more prevalent in the US than in either Europe or the APAC region. However, overall the trends are all heading in the same direction—and it is easy to see what is behind these trends,” Dinsdale said.

Dinsdale attributes the shift to changes in enterprise spending. In 2012, enterprises spent twelve times more on data center hardware and software compared to cloud infrastructure services. Today, that trend has reversed, with enterprises now spending three times more on cloud services than on their own data center infrastructure.

Enterprises are increasingly opting for colocation facilities to house their data center gear, which further reduces the need for on-premise data centers. “The rise of generative AI technology and services will only exacerbate those trends over the next few years, as hyperscale operators are better positioned to run AI operations than most enterprises,” Dinsdale added.

In a related study, Synergy found that enterprise spending on cloud computing reached $79 billion in the second quarter of 2024. This continued investment underscores the shift towards cloud services and away from traditional on-premise solutions.

Africa presents vast opportunities for data center growth, driven by enterprise demand from sectors such as financial, technology, and healthcare, as well as cloud adoption and emerging artificial intelligence applications. With limited hyperscaler presence, the continent offers significant potential for data center uptake, making it an exciting frontier for growth and investment for foreign and local investors.