Global alternative asset management leader DigitalBridge Group, Inc. proudly announces the successful completion of its inaugural digital infrastructure credit fund, DigitalBridge Credit (Onshore), LP, and parallel vehicles collectively referred to as “DBC” or the “Fund.” The Fund secured aggregate commitments of $1.1 billion, including co-investment commitments alongside the Fund.

DigitalBridge’s credit strategy, embodied by DBC, aims to provide investment solutions supporting the growth of companies within the digital infrastructure sector. The Fund has garnered support from a diverse global investor base, including pension funds, insurance companies, sovereign wealth funds, asset managers, family offices, and private wealth platforms. This success is attributed to contributions from both existing DigitalBridge investors and new investors with a specific interest in infrastructure credit.

Dean Criares, Head of Credit at DigitalBridge, expressed his enthusiasm, stating, “This closing is an important milestone for the firm’s credit platform and reflects great partnership with investors and clients.” He continued, “Establishing DigitalBridge’s brand within the expanding private credit sector reflects support from senior management and the strength of our relationships and partnerships with industry experts as we source and diligence opportunities.”

Criares highlighted the strategic timing for investments in the digital infrastructure industry, emphasizing the belief that the addressable market is large and expanding, providing ample opportunities to deliver quality assets to investors at a predictable pace.

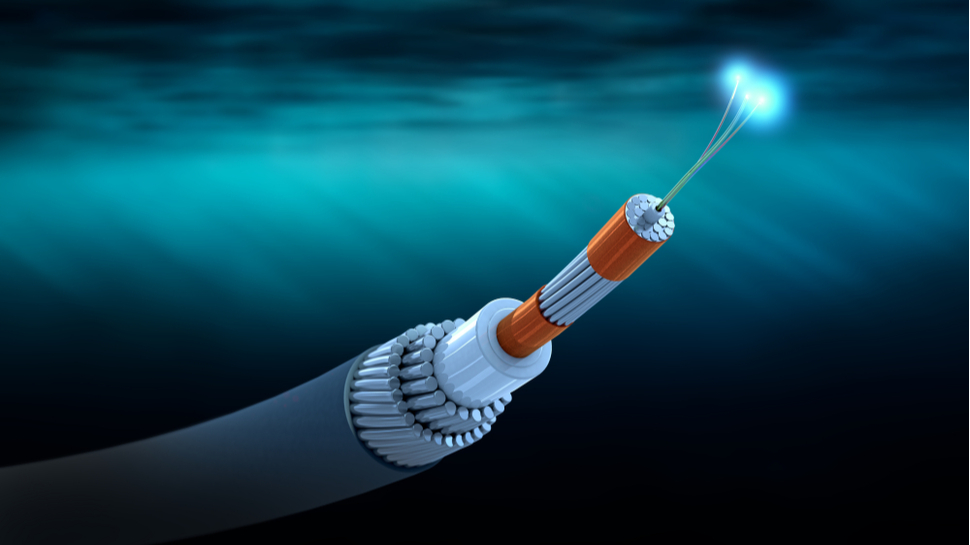

The DigitalBridge Credit team has already executed 11 investments across various digital infrastructure sub-sectors, including Data Centers, Fiber, Satellite Broadband, and Cloud Infrastructure. The DigitalBridge Credit strategy specifically targets debt investments across all sub-sectors of Digital Infrastructure, emphasizing current income-based returns in first-lien term loans, second-lien term loans, and junior debt.