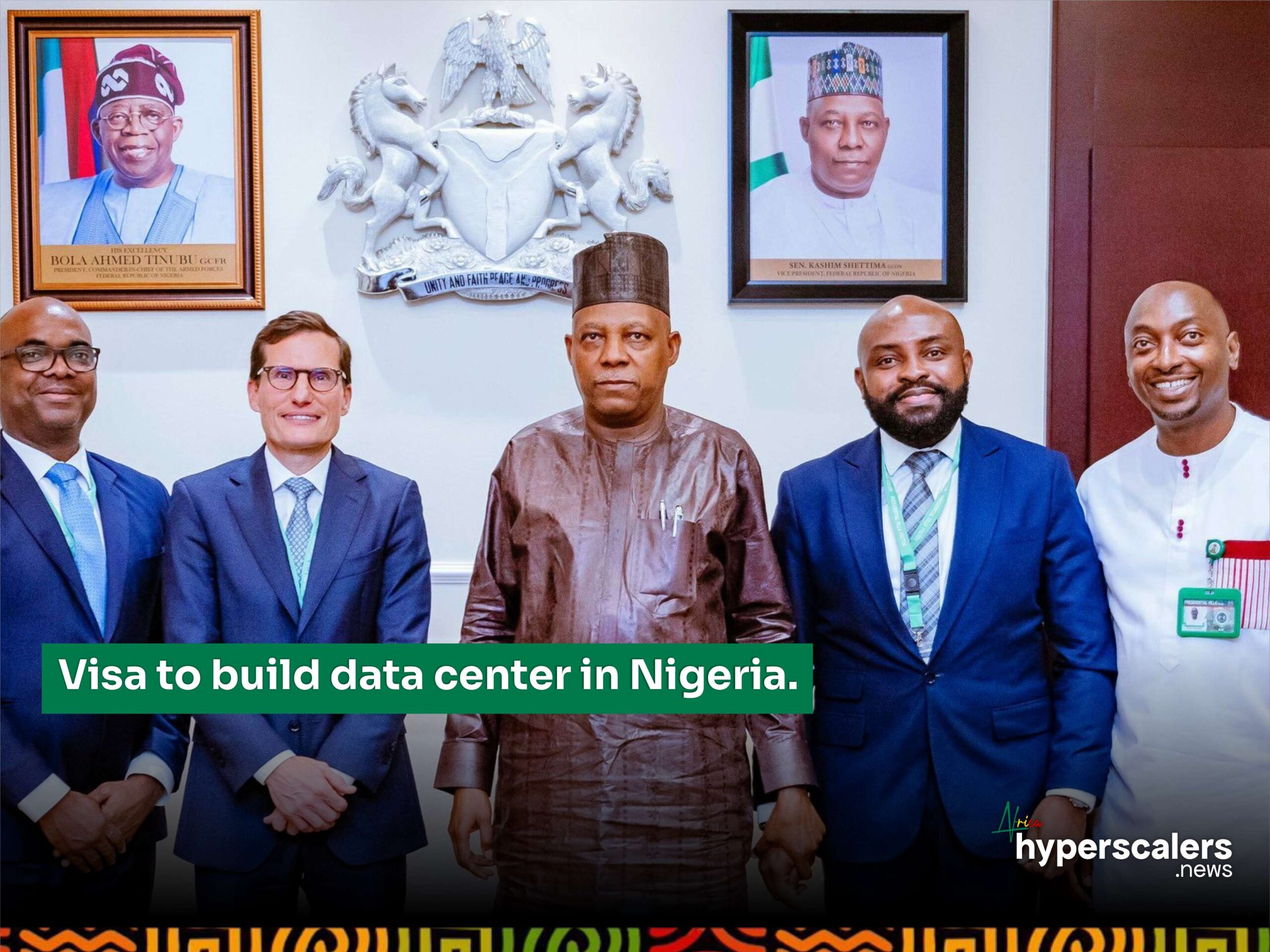

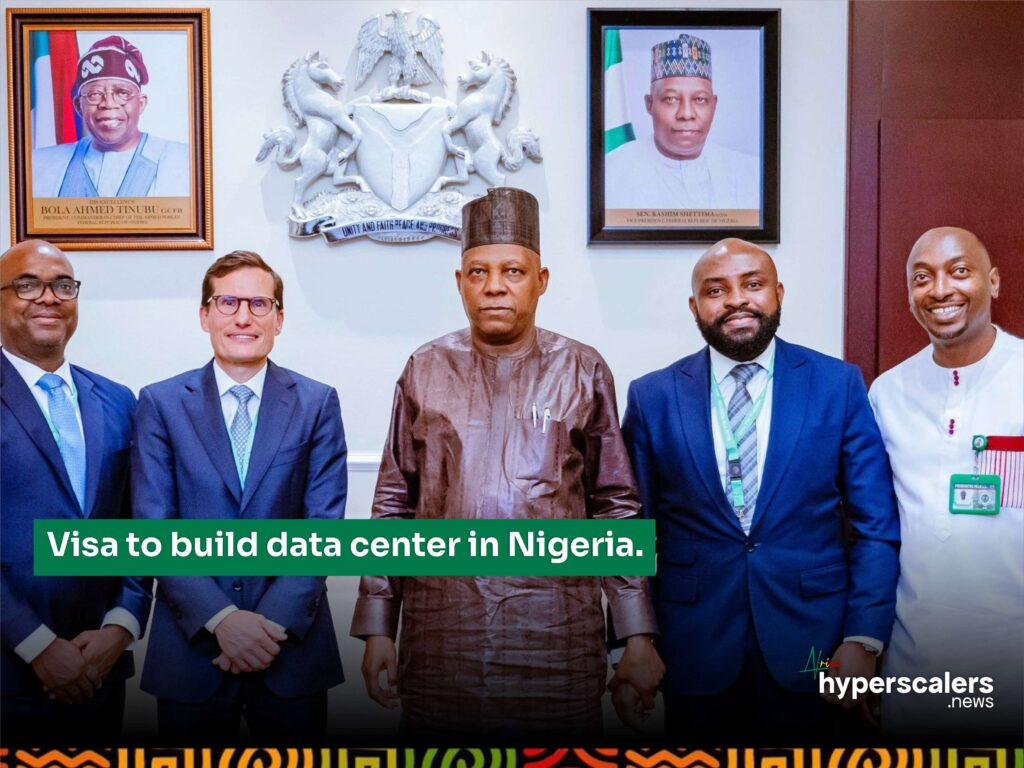

Global payments giant Visa Inc. has announced plans to develop a data center in Nigeria, further expanding its investments in the country. The news was revealed by Andrew Torre, Visa’s regional president for Central & Eastern Europe, the Middle East, and Africa. This initiative comes in addition to the $1 billion Visa has already invested in Nigeria.

Torre emphasized Visa’s ongoing commitment to the Nigerian market, stating, “Visa has been making investments and will continue to make these investments in Nigeria.” He added that the data center is expected to introduce new technologies and strengthen Nigeria’s digital economy.

Torre noted that Visa’s partners, including Hugo and Samsung, rely on Visa technologies to launch mobile payment services in the country. However, details regarding the data center’s location and specifications have not yet been disclosed.

Beyond its data center plans, Visa has made significant investments in Nigeria’s financial and agricultural sectors. This includes a $200 million investment in Interswitch, a leading African payment technology company, and a partnership with ThriveAgric, a tech-driven company supporting smallholder farmers.

Nigeria’s Vice President, Kashim Shettima, underscored the country’s growing fintech landscape and the government’s focus on modernizing agriculture. “Nigeria is where the action is. Of the ten fintechs in Africa, about eight are in Nigeria, with Moniepoint as the newest addition. Agriculture is key to the 8-point agenda of the present administration. President Bola Ahmed Tinubu is really keen on repositioning the agriculture industry here, and we have to invest in technology, we have to invest in modernization… And be rest assured that the patronage, the partnership between the government of Nigeria and Visa will only grow by leaps and bounds,” he said.

Visa currently operates four data centers worldwide – two in the United States, one in the United Kingdom, and one in Singapore. These facilities are critical to enhancing the company’s ability to deliver secure, reliable digital payment services, support fintech innovation, and contribute to economic growth in their host markets.

As Visa continues to strengthen its infrastructure footprint, competition in the African fintech space is intensifying. Mastercard recently invested $200 million for a 3.8% stake in MTN’s mobile money fintech arm, targeting access to the telecom giant’s 60 million mobile money users. The move signals Mastercard’s intent to deepen its presence in Africa’s rapidly growing digital payments ecosystem, as both companies position themselves to capture a larger share of the continent’s fintech opportunity.