The Asia Pacific (APAC) region is poised to overtake the United States as the world’s largest colocation (colo) market before the end of the decade, according to a new report by real estate advisory firm Cushman & Wakefield.

Titled “Asia Pacific Data Center Investment Landscape”, the report projects that by 2030, the APAC region will command 23,904 megawatts (MW) of colocation capacity, well ahead of the 18,256MW expected in the US. This positions APAC to lead not only in total capacity but also in rental revenue.

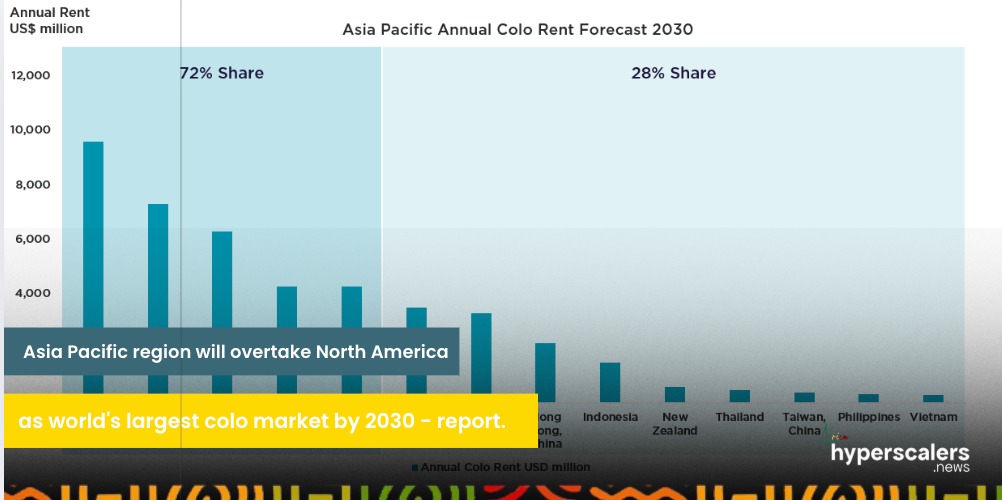

The study estimates that 72 percent of APAC’s projected $44 billion in annual colocation rental revenue in 2030 will come from just five markets, ranked by descending capacity: Japan, Mainland China, Australia, India, and Malaysia.

“Various forecast models show that Asia Pacific will overtake the United States as the largest colocation market in either 2028 or 2029,” said Pritesh Swamy, Head of Insights and Analysis at Cushman and Wakefield’s Asia Pacific data center group.

“Based on the population differential, this is expected, but still significant given the depth and maturity of the US market.”

Currently, APAC’s average of 350,000 people per megawatt (MW) of data center capacity far exceeds the US ratio of 19,314 people per MW, highlighting the region’s lower data center density relative to its population.

However, the report predicts this gap will narrow as investment in infrastructure accelerates. By 2030, the APAC region is expected to reduce its people-per-MW figure to around 158,000, reflecting major growth in capacity across emerging markets.

While markets like Hong Kong, Singapore, Australia, and Malaysia already have ratios lower than the US, regional averages are skewed by underdeveloped data center ecosystems in high-population countries like India, Indonesia, Vietnam, the Philippines, and Mainland China.

The report also highlights the dominance of colocation data centers in APAC, which account for 85 percent of the region’s total operational data centers, compared to 58 percent in the Americas and 75 percent in EMEA. Although this gap is expected to narrow, APAC’s high reliance on colocation reflects both rising demand and the need for scalable, agile infrastructure.

North American colocation hubs, such as North Virginia, US, which is home to over 300 data centers and boasts over 2500 megawatts of commissioned power, account for 13% of global data center operational capacity and 25% of capacity in the Americas.

While American hyperscalers continue to expand, and their increasing use of colocation facilities to meet demand for cloud and AI services will contribute to a more balanced global distribution in data center infrastructure, the Asia Pacific is sprinting ahead in colocation growth, fueled by aggressive spending, regulatory support, and hyperscaler activity. Hyperscalers are looking for reliable power availability, scalable land parcels, regulatory clarity, and fast deployment timelines to justify their investments. For African countries seeking to attract colocation growth and hyperscaler presence, prioritising energy infrastructure, land availability, and supportive policies is essential to compete in this global data infrastructure race.